Many people think you need much money to start investing in the stock market. But that’s not true. You can invest in stock market even if you have just ₹500. You only need to know the proper steps. This guide will help you understand how to start small and grow your money over time.

Read Also: Basics of Stock Market

Contents

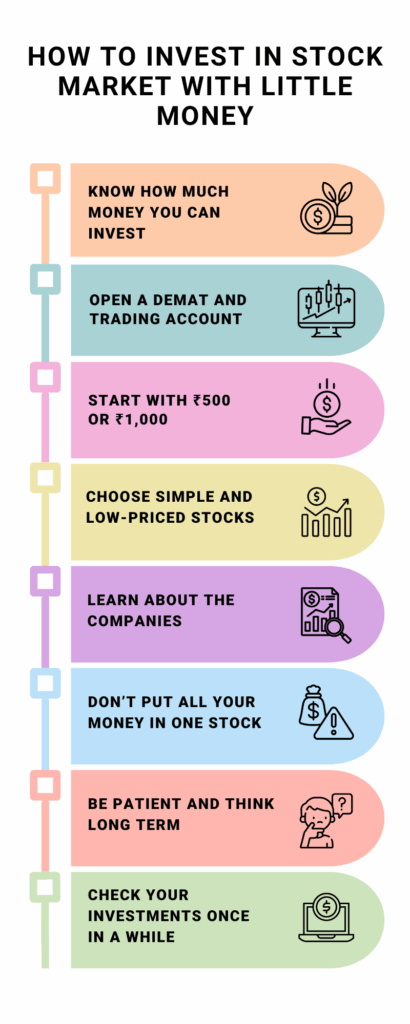

- Step 1: Know How Much Money You Can Invest

- Step 2: Open a Demat and Trading Account

- Step 3: Start With ₹500 or ₹1,000

- Step 4: Choose Simple and Low-Priced Stocks

- Step 5: Learn About the Companies

- Step 6: Don’t Put All Your Money in One Stock

- Step 7: Be Patient and Think Long Term

- Step 8: Check Your Investments Once in a While

- Conclusion

- FAQs

Step 1: Know How Much Money You Can Invest

Before investing, look at your income and expenses. This means checking how much money you earn and how much you spend every month. After that, you will know how much money is left. This leftover money is what you can safely use for investment. It is essential never to invest money you need for food, rent, education, or emergencies.

Step 2: Open a Demat and Trading Account

To buy and sell shares, you must open two accounts:

- Demat Account: It holds your shares.

- Trading Account: It helps you buy and sell shares.

You can open these accounts with banks or online apps. Today, many apps are easy to use and charge very low fees. Look for a simple platform with good reviews that does not charge too much for buying or selling shares.

Step 3: Start With ₹500 or ₹1,000

Many platforms allow you to start investing with ₹500. You do not need to buy full shares of expensive companies. Some platforms allow fractional shares, where you can buy a small part of a stock.

You can also use something called a SIP (Systematic Investment Plan). This means you can invest a fixed amount (like ₹500) monthly in a stock or fund. It helps you build your investment slowly without feeling a burden.

Step 4: Choose Simple and Low-Priced Stocks

If your budget is small, you can look at beginner stocks or affordable stocks. These stocks are priced low and are easier for beginners to understand. But be careful—just because a stock is cheap doesn’t mean it’s good.

You can also invest in ETFs (Exchange Traded Funds). These are groups of stocks that follow the market. They cost less and are a good option if you don’t want to pick individual companies.

Step 5: Learn About the Companies

Before you buy a stock, try to learn more about the company. Ask these simple questions:

- What does the company make or do?

- Has it been in business for a long time?

- Is the company making profits?

You don’t need to be an expert. Just spend a little time reading about the company on trusted news or financial websites. This step is called researching and analyzing stocks. It helps you avoid bad choices.

Step 6: Don’t Put All Your Money in One Stock

This is called diversifying your portfolio. If you put all your money in one stock and that stock falls, you may lose money. But if you invest in different companies, your risk is lower. Even if one stock goes down, others may go up and balance the loss.

For example, you can divide ₹1,000 into four different stocks, ₹250 each. This way, you are not depending on only one company.

Read Also: Portfolio Diversification: Why It Matters More Than You Think

Step 7: Be Patient and Think Long Term

The stock market is not a place to get rich quickly. Sometimes, prices go up and down. This is normal. If you panic and sell quickly, you may lose money. But if you stay invested longer, there is a better chance of growing your money.

Investing regularly, even in small amounts, helps build wealth slowly. This is a smart way for beginners to get started.

Risk Disclaimer: Investing in stocks comes with ups and downs. Prices can fall or rise. So always be careful and make informed choices.

Conclusion

Starting your journey in the stock market doesn’t need much money. With just ₹500 or ₹1,000, you can begin building your future. The most important thing is to take small steps, stay patient, and learn as you go.

Use a trusted platform, invest regularly, and choose simple stocks or funds you understand. Don’t rush. Over time, even small investments can grow.

Everyone starts small. What matters is that you start.

Disclaimer: Investment in the securities market is subject to market risks. Please read all scheme-related documents carefully before investing. The information provided in this article is for educational and informational purposes only and is not intended as investment advice. Trading in derivatives, including options, involves substantial risk and is not suitable for all investors. Past performance is not indicative of future results. Readers are advised to consult with their financial advisors before making any trading decisions.

FAQs

Yes, ₹1,000 is a good starting amount. You can buy small shares or use it to start a monthly SIP in a mutual fund or ETF.

Using online platforms, you can invest in stocks, mutual funds, or ETFs. Some apps allow investments as low as ₹100 or ₹500.

Start with a trusted app, open a Demat account, and invest in simple, low-cost stocks or index funds regularly through SIP.