Profitmart Mutual Funds – Your Path to Smart Investing

Why Choose Profitmart for Mutual Funds?

Profitmart helps you discover the right mutual funds for your investments.

Wide Range of Mutual Funds

Flexible Investment Plans

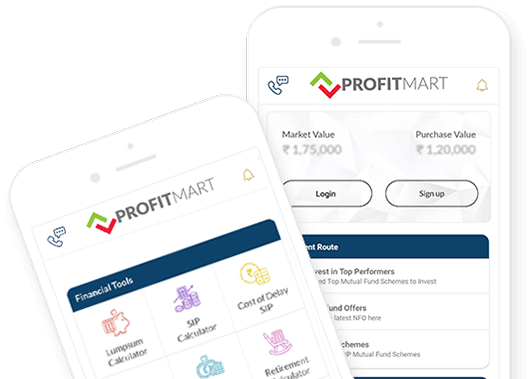

Advanced Tools & Calculators

Utilise our mutual fund investment calculator and mutual fund return calculator to plan your investments effectively.

Direct Mutual Fund Investments

Save on commissions by investing directly in mutual funds through Profitmart’s platform.

Comprehensive Market Insights

Access detailed analysis and reports on the highest return mutual funds over the last 10 years.

User-Friendly Platform

Secure & Transparent

Invest confidently, knowing your transactions are secure and all fees are transparent.

Dedicated Support

Receive assistance from our expert team to help you make informed investment dec isions.

Advanced Features

Real-Time Portfolio Tracking

Monitor your investments with real-time updates and comprehensive portfolio tracking tools.

Sector-Specific Funds

Index Funds & ELSS

Utilise our mutual fund investment calculator and mutual fund return calculator to plan your investments effectively.

Automated SIPs & Stock SIPs

Automate your investments with SIPs and explore stock SIP options for disciplined investing.

What our Customers Say

Our users appreciate our exceptional customer service and simplicity.

I’ve transformed myself from a housewife to an active investor. It’s been a wonderful journey with Profitmart. I am very thankful to them.

Smitha Srinivasa

The software platform is excellent including the back office. The services offered are also satisfactory.

Mrs.Jyoti Milan Kumar

I am investing from the last few months and really feel blessed to use Profitmart. Their sales and support team is really awesome. They are always ready to help!

CA Hemant Shah

Wow Profitmart, I really going to recommend all people to start trading and investment with Profitmart. they are really very helpful for trader like me which love option trading

Mehul Dougall

FAQs

Is mutual fund investing profitable?

How do you select mutual funds for investment in India?

What are the advantages of investing in mutual funds?

How can I invest in mutual funds through Profitmart?

What is the best time to invest in mutual funds?

Can government employees invest in mutual funds?

Is it safe to invest in mutual funds?

Which is the best place to invest in mutual funds?

Which platform is best for mutual fund investment?

What is the difference between an equity fund and a mutual fund?

Can I withdraw money from a mutual fund anytime?

Do mutual funds have tax benefits?

How to calculate tax on mutual fund redemption?

What is CAGR in mutual funds?

What is XIRR in mutual funds?

NPS vs mutual fund:

PMS vs mutual fund:

What is SIP in mutual funds?

What is an NFO in mutual funds?

What is SWP in mutual funds?

Which mutual fund is best for SIP?

What is the exit load in mutual funds?

What is AUM in mutual funds?

What is a debt mutual fund?

What is an ELSS mutual fund?

What is an equity mutual fund?

ETF vs mutual fund:

Direct vs regular mutual fund:

SIP vs mutual fund:

Index fund vs mutual fund:

FD vs mutual fund:

Mutual funds vs stocks

ULIP vs mutual fund:

Gold ETF vs gold mutual fund:

Active vs passive mutual funds:

Legacy of Quality and Commitment to Excellence

Profitmart is the Most Trusted and Fastest growing stock broker in india