Open a Demat and Trading Account with Profitmart

Seamlessly start your investment journey today. With an intuitive, secure platform, Profitmart helps you trade smarter and reach your financial goals.

Accelerate Your Investment Journey

Join over 2.5 lakh traders and investors who trust Profitmart to navigate the markets. Whether you’re new to investing or a seasoned trader, Profitmart’s intuitive platforms empower you to reach your financial goals with ease and confidence. Dive into a seamless trading experience and watch your investments grow.

Click to Open Demat Account Online

Start Trading in 2 hours

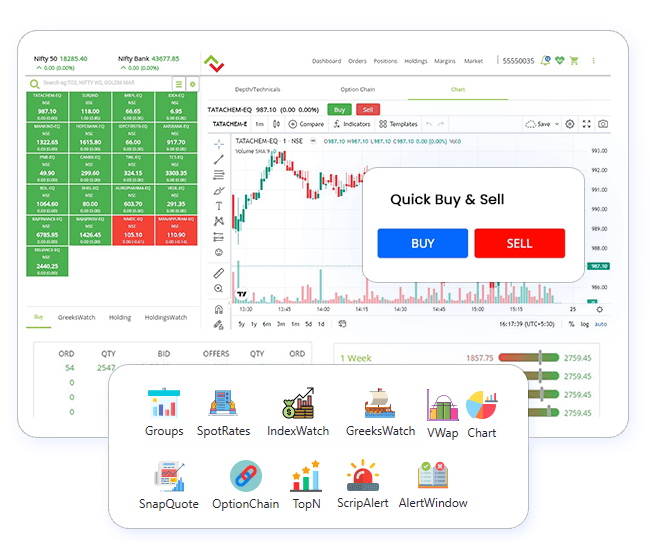

Easy-to-Use Trading and Investing Products

Our advanced technology helps you to become a smart Investor

ProfitMax App

Advanced features, easy to use, and secure trading and investing app for Android and iOS phones

ProfitMax Web

Bigger Screen for Trading & Investing on the Web with Advanced charting tools, secure and intuitive interface.

ProfitMax EXE

Most powerful and advanced desktop trading and investing platform for a smart investor

Start Investing in

Stocks

Commodities

Future & Option

Currencies

Mutual Funds

IPO

IPO

Mutual Funds

Awards & Recognition

Customer satisfaction is our greatest achievement

of Index Futures

2024

BY MCX

Companies To

Work By National

Economic Growth

Summit 2024

of Index Futures

2021-2022

BY MCX

of the Exchange

2020-2021

BY MCX

Client Business

2019-2020

BY MCX

Mumbai

Financial

Startups 2020

Broker 2016-17

MCX, PAN India

Category

Excellence Award

BY Dainik

Bhaskar Group

Legacy of Quality and Commitment to Excellence

Profitmart is the Most Trusted and Fastest growing stock broker in india

13+

Years of Trust

2.5L

Trusted Clients

35+

Branches

How to Open Demat Account

Open a Demat account through Profitmart, if you are looking forward to investing in the share market. We offer attractive brokerage plans, transparent transaction, advanced mobile trading application and expert guidance.

Fill and Verify your personal details

Complete all your KYC Process

Digitally sign your documents with e-Signature

Step By Step Procedure To Open A Trading & Demat Account Online

To open a new account, simply follow these steps:

-click on Button “Open Demat Account”.

Step 2: Fill in Your Details

-Fill in your Mobile Number, Email, and Name, then click on Generate OTP.

-The first three digits of OTP are sent to your Mobile number and the last three digits are sent to your Email ID

-Copy that OTP and enter OTP Box

Step 3: Complete Your KYC Process

-Fill in your PAN Card details and Date of Birth

-If your KRA is already registered, then it will show the existing data with the respective KRA. If there is no change in existing data, then your account will activate after the proper validation.

-If your KRA has not been done before you will get NOT Verified by KRA Massage

-Validate your Aadhaar with the help of DigiLocker

-Select option of the “Fetch Address from Aadhaar”

-Then click on the button Fetch From DigiLocker

-While authenticating Aadhaar with DigiLocker, you will be asked for a 6-digit PIN Code post-OTP verification.

-After completing the KYC Process, then Enter the last 4 digits of your aadhaar card number and Click on the “Save and Continue” Button.

Step 4: Fill in Your Personal Details

-Your Address is automatically fetched here

-Please read the client Undertaking note and click on the “Checkbox” then click the “OK” button

-Now Select the Segment and Select AMC Scheme

-Enter Nomine Details if you want

Step 5: Fill in Your Bank Account Details

-Enter your bank account number and IFSC Code.

Step 6: Upload Mandatory Documents

-Pan Card, Aadhaar Card, signature in JPEG Format under 20KB, Last 6 months’ bank statement.

Step 7: Select Brokerage Plan

-Make Payment online for AMC Charges

Step 8: Complete Your E-Signature Process

-Click on the Esign button

-Now Provide an IPV (In-person verification).

You will get IPV Link on your Email and Mobile Number. Please open that link and complete your IPV process by showing your face.

along with ID proof to the camera and click to submit.

-Now again click on the Esign button and E-sign the documents by verifying your Aadhaar with your Mobile Number.

-If you are non-KRA, then you should complete the E – Sign stage twice.

Step 9: Now Congratulations You are successfully completed your account opening process

your account will be activated as soon as possible

What is a Demat Account?

Most of you may be thinking as to what is a Demat account? Demat is a short form of Dematerialized account. In the world of trading and investment, the term Demat account is commonly used.

A Demat account or a dematerialized account that holds financial security including debt and equity in an electronic form. There is two depository organization in the country, where you can open your Demat account. The two depository organizations are:

National securities depository central

Central depository services limited.

Benefits of Demat account from Profitmart?

In India, Profitmart is one of the leading stock broker in India. One gets several benefits when one opens a Demat account through us. And some of the benefits are mentioned below:

Fastest account opening process

Attractive Brokerage

Advanced Mobile Trading App

Dedicated Relationship Manager

Documents required for opening a Demat account

Getting exposed to the basics of a Demat account, you should know about the documents required to open a Demat account. Here’s the list of documents that are required to open a Demat account

Identity Proof

Address Proof

Income proof

Bank Account Proof

Signature

Photograph

Why you should open a Demat account?

There are a plethora of reasons that necessitates opening a Demat account. Few of the reasons are